Month / July 2009

Understanding the General Audience

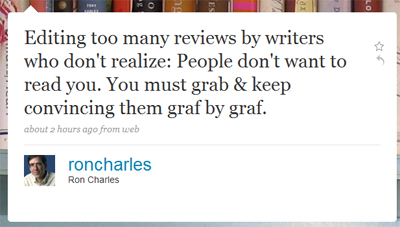

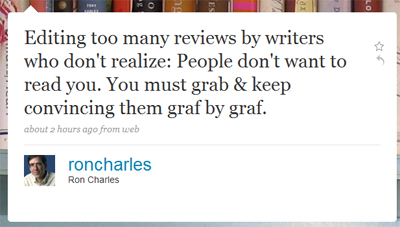

On the morning of July 21, 2009, Washington Post books editor Ron Charles expressed some concerns about book reviewers on Twitter:

At the risk of clearing my own throat (and with all due respect to Mr. Charles), I’m wondering if the 2008 winner of the Balakian Citation for Excellence in Reviewing really has a handle on the type of writing that is likely to attract readers to his newspaper section.

Mr. Charles’s editorial sensibilities call for clear and direct writing. But his other entreaties are problematic. He asks that a first-person perspective or a sense of playfulness through reference — vital variables that might permit readers to get excited, interested, or enthused about a book — be omitted from the equation. Mr. Charles cannot seem to corral the idea of grabbing an audience with each graf with the possibility that readers may be interested with what a particular voice has to say (see, for example, the rise of litblogs over the past six years). Indeed, if Mr. Charles is desirous of a more objective journalistic approach, should not the ideal reviewer be someone who permits a reader to make up her own mind? Mr. Charles’s sentiments appear to reflect a newspaper culture in which personality or perspective — those indelible human traits that make us interested in people on so many levels — don’t get a hot seat at the formal table. Unless, of course, the reviewer is “truly famous,” which connotes a troubling elitism that runs counter to Mr. Charles’s seemingly egalitarian-minded agenda.

We should probably ask ourselves whether there is even a “general audience” for books. I think a case can certainly be made, provided you keep in mind that a “general audience” doesn’t just consume the type of pretentious literary fiction involving suburban asshats and cricket bats. We have seen millions of people get excited over the Harry Potter books (and their cinematic counterparts; see the box office bonanza in the past week). As I discussed with Sarah Wendell and Candy Tan in a recent podcast interview about the romance genre, over 64 million people claimed to read a romance novel in 2004. If Mr. Charles is genuinely committed to a “general audience,” surely he would open up his books section to more romance coverage. (Certainly, Mr. Charles’s coverage of Nora Roberts is a start.) And if the Washington Post is sincerely devoted to attracting a “general audience,” they may wish to do away with the annoying and obtrusive registration prompts that pester us for personal information.

But let’s examine a typical lede for a Washington Post review. Let’s take, simply at random, the first fiction review on today’s Washington Post books page: Mke Reed on Colum McCann’s Let the Great World Spin. Here’s the lede:

As the narrator of Colum McCann’s new novel sees it, Philippe Petit’s tightrope walk between the World Trade Center towers in 1974 triggered a quietude generally unknown to New Yorkers.

We can do away with the superfluous opening clause. There’s no need to inform the reader that this is a review about Colum McCann’s latest book. We already know this. So this leaves us with:

Philippe Petit’s tightrope walk between the World Trade Center towers in 1974 triggered a quietude generally unknown to New Yorkers.

Okay, we have a few interesting concepts to play with here. There’s the exciting prospect of Philippe Petit’s tightrope walk, which is rendered remarkably cold and objective through the bland reportorial phrasing. There’s the more intriguing concept of “triggered a quietude generally unknown.” That phrasing is clumsy, hardly as “clear” and “direct” as Mr. Charles demands. (Is the “triggering” a reference to 9/11? Were New Yorkers really quietly in awe for the first time in 1974?) But there’s some poetic potential here. Perhaps if we take the metaphor and front-load it at the beginning of the sentence, we might have a more compelling lede:

His high wire walk between the twin towers triggered an explosive awe among New Yorkers.

Okay, this isn’t perfect, but it’s an improvement. If the reader is unfamiliar with Petit (or familiar with the 2008 Petit documentary Man on Wire), she’ll be compelled to move onto the next sentence. By switching “tightrope” to “high wire,” we not only provide cultural context for a reader (“Hey, isn’t that the Man on Wire documentary?”) who soaks up art more from cinema than from books, but we also neatly foreshadow the “explosive trigger” metaphor later in the sentence. (Do you cut the red wire or the green wire?) By removing the subjective “generally unknown” assumption about New Yorkers, we do away with a superfluous aside that has little to do with the paragraph’s main purpose here.

With a few modest editorial changes, not only do we have a lede that is more of interest to a general audience, but we also don’t insult the audience’s intelligence by littering their attentive bin with the detritus of clinical phrasing.

Of course, one can avoid these disastrous results by daring to write in the first-person. Ernest Hemingway once wrote an essay about writing in the first-person — which can be found in A Moveable Feast — in which he suggested, “When you first start writing stories in the first person, if the stories are made so real that people believe them, the people reading them nearly always think the stories really happened to you.” Hemingway was referring primarily to fiction, but the advice nevertheless points to one primary deficiency among the newspapers — namely, an ability to give the reader a sense that he is a colleague, not some peon to be dictated to, and that literature is something to be experienced rather than cheerlessly discussed over tea and scones.

Critical Ass

From the latest National Book Critics Circle newsletter:

Eric Banks then spoke about the blogging committee. Our blog visitor numbers, he said, are down sharply. We’re getting only 10,000 visits per month, with an average of 250-500 each day. One of the problems is that Google is misdirecting people to the old blog which is no longer forwarding reliably to the new one. It was suggested that we create a wikiprofile and Jane Ciabattari underlined the importance of blog visits when it comes to our application for NEA funding. Everyone, Eric Banks urged, needs to help by thinking of ideas for new posts, even if they are only a few sentences long. One idea in the works is a series of interviews with editors about the move toward on-line reviewing. Laurie Muchnick suggested a sort of six-question template for editors, the answers to which we could post periodically.

How do I put this delicately? Perhaps the numbers are down because the content put up isn’t exactly scintillating. Perhaps the failure to link and include other bloggers, whether NBCC or non-NBCC, might be one of the reasons why nobody cares to visit the site. Perhaps nobody really cares about what stuffy and humorless book critics have to say about $27 hardcovers that regular people can’t afford to read because the unemployment rate is rising and the job market now sees 200 people applying for a busboy job and there are pedantic matters such as figuring out which relative you can ask to loan you the money to pay the rent and keep food on the table. Assuming you are even that lucky.

There are endless possibilities here. And it’s certainly not going to be remedied by a six-question template for editors or a wikiprofile. I don’t believe that James Wood has ever required a six-question template for editors or a wikiprofile. But if decent blog stats can get you NEA money to survive, just where in the hell is the bailout money for the bloggers?

The History of Verizon, Part Four (November 2000 to December 2000)

[EDITOR’S NOTE: This post continues my comprehensive history about the expansion of Verizon. This most recent installment takes the story through the end of 2000. Part One, which concerns itself with April to August 2000, can be found here. Part Two, which concerns itself with August 2000, can be found here. Part Three, which concerns itself with September and October 2000, can be found here.]

Like any mushrooming company hoping to discharge its spores upon every square mile in a new field, Verizon had its lobbyists. In 1999 and 2000, Verizon, BellSouth, and SBC gave more than $7.1 million to political parties and federal campaigns, ensuring that they were among the top 25 donors. The funds were well-timed, arriving in Washington just as Congress was in the process of loosening restrictions.

Like any mushrooming company hoping to discharge its spores upon every square mile in a new field, Verizon had its lobbyists. In 1999 and 2000, Verizon, BellSouth, and SBC gave more than $7.1 million to political parties and federal campaigns, ensuring that they were among the top 25 donors. The funds were well-timed, arriving in Washington just as Congress was in the process of loosening restrictions.

AT&T perhaps had the most to lose from attempting to influence the reordering of the telecom guard. Faced with the October surprise of splitting itself up into four parts, AT&T alone had contributed $4.3 million during the 2000 election cycle. It was facing complaints from its investors.

Meanwhile, the telecommunications companies were beginning to enter more long-distance markets. Verizon, of course, knew when to steer clear of federal legislation or, more accurately, precisely when to time its actions in relation to governmental and competitive developments. Near the close of 2000, it withdrew its application for Massachusetts long-distance services. (Verizon was then under scrutiny from other telecom providers. In April 2001, it would receive federal approval in Massachusetts, where the competition would heat up.)

By the end of October, Verizon may have been doing okay in the stock market. But its third-quarter profit was flat. The money that Verizon had spent to dominate DSL and long-distance markets with discount pricing had remained the same from the year earlier. Verizon profits in Q3 2000 were $1.99 billion, whereas Bell Atlantic profits had been $2 billion a year earlier. The m.o. involved spending and undercutting. But this seemed enough to assuage Wall Street.

By the end of October, Verizon may have been doing okay in the stock market. But its third-quarter profit was flat. The money that Verizon had spent to dominate DSL and long-distance markets with discount pricing had remained the same from the year earlier. Verizon profits in Q3 2000 were $1.99 billion, whereas Bell Atlantic profits had been $2 billion a year earlier. The m.o. involved spending and undercutting. But this seemed enough to assuage Wall Street.

Profits needed to come from somewhere. But there was also the matter of eager consumers trying to find the cheapest possible price on DSL. Local telephone service was the logical place to start jacking up prices. On November 1, 2000, while Verizon New Jersey proposed to double basic telephone rates from $8.19 a month to anywhere from $15-17 a month, regulators called a hearing. Elderly customers complained that they would be saddled with undesired expenses and undesired services. Verizon’s argument was that it cost them much more than $8.19 a month to provide basic telephone service to its customers, but Verizon spokeswoman Soraya Rodriguez did confess that there wasn’t much in the way of competition for local service

These sentiments were in sharp contrast to the Bell Atlantic days. In 1992, Bell Atlantic had brokered a deal with Trenton. They would rewire Jersey lines if the state loosened Bell Atlantic from a regulative loophole that forced it to lower rates if it made an unreasonable profit. In 1997, the New Jersey Board of Public Utilities had stood its ground. The result was that Trenton had managed to get its line rewired and New Jersey customers had experienced some of the cheapest local telephone service in the country. But Anthony Wright, the program director for New Jersey Citizen Action, would organize opposition to the plan and score a victory later in the year. This was, however, not the end of Verizon’s efforts to squeeze profits out of local telephone service, as subequent 2004 efforts in the Northwest would eventually reveal. (Indeed, in early 2008, Verizon would play this card again when telephone deregulation was on the table. Regulation was retained, but, by 2011, local Verizon telephone service in New Jersey will be set at $16.54 a month. Verizon, as it turned out, could fight just as hard as New Jersey Citizen Action could.)

Verizon had, by this time, seemingly escaped from the lingering smoke wafting from the August strike. In New York State, the backlog for new lines had been eliminated by October 23, 2000. Or so Verizon claimed. In November, there were still reports of new apartments waiting for service in a 33-story tower declared “The Ultimate in Brooklyn Heights Luxury.”

Verizon continued to expand. Verizon Communications owned 40% of Venezuela’s national telephone company. And there was the $1.5 billion acquisition of Price Communications Wireless, which served the Southeast, but also faced $550 million in debt that Verizon also took on. And, as previously documented, Verizon backed out of the NorthPoint deal.

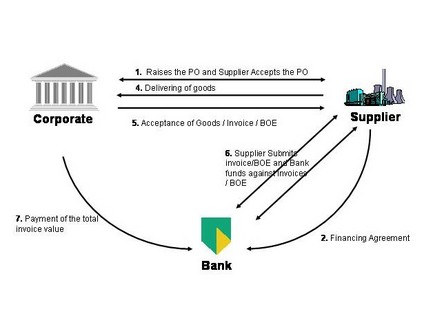

But what was particularly interesting was the amount of debt held by seven major telecommunications companies. In August 2000, Lehman Brothers analyst Ravi Suria wrote a report titled “The Other Side of Leverage,” which pointed to the weaknesses of vendor financing. Vendor financing was precisely what Verizon specialized in. It was a practice that permitted customers to buy their own equipment through unseen financial burdens managed by the company. Suria pointed out that the telecom companies had increased their share of the convertibles market from 5% in 1998 to 20% in 1999. (A convertible is a type of security that can be converted into another form of security — such as a share in a company.) Verizon had managed to pass off much of its debt through their convertibles, because there was no way to squeeze out significant profit from the networks at the time and there was no way to cover the interest payments on accumulating debt. Over the course of four years, the combined debt and convertible bonds of the seven telecoms that Suria was studying had dwarfed to $275 billion. As the New York Times‘s Gretchen Morgenson observed, this was a significant change from the $160 billion in junk bonds generated between 1983 and 1990.

And yet even Suria seemed convinced that there were promising possibilities in the telecom industry. Perhaps Verizon’s faith emerged from the possibilities of keeping customers on-board for life. After all, if you could wipe out the competition, eventually the customer would have no other choice but the Verizon network. And if you could lock a Verizon Wireless customer into a two-year contract, you could then tell your investors that convertibles were merely a “temporary” high-yield debt taken on while waiting for the almighty profits. Perhaps vendor financing represented a new method for Verizon to utilize Ricardo’s comparative advantage theory.

The equipment vendors buying into this infrastructure had to be somewhat concerned about this high-stakes gamble, but the possibilities of profit seemed to negate financial pragmatism. In Lisa Endlich’s Optical Illusions, Endlich reports that, in 1996, Lucent’s Controller was initially skeptical about expanding on such a significant lending risk. Jim Lusk, the Controller at the time, was an old-fashioned finance type who needed to see how the money was going to pay out and who believed that Lucent should stick to selling equipment rather than lending money, even he turned around for a contract that secured 60% of Sprint PCS’s contract. The cost? $1.8 billion, with payment of principal deferred for four years. Small wonder then when, four years later, Lucent was in bad shape, with the CEO replaced and investors demanding an overhaul. But then, by the end of 2000, the nine largest telecom equipment suppliers had a combined $25.6 billion in vendor financing loans to customers.

The equipment vendors buying into this infrastructure had to be somewhat concerned about this high-stakes gamble, but the possibilities of profit seemed to negate financial pragmatism. In Lisa Endlich’s Optical Illusions, Endlich reports that, in 1996, Lucent’s Controller was initially skeptical about expanding on such a significant lending risk. Jim Lusk, the Controller at the time, was an old-fashioned finance type who needed to see how the money was going to pay out and who believed that Lucent should stick to selling equipment rather than lending money, even he turned around for a contract that secured 60% of Sprint PCS’s contract. The cost? $1.8 billion, with payment of principal deferred for four years. Small wonder then when, four years later, Lucent was in bad shape, with the CEO replaced and investors demanding an overhaul. But then, by the end of 2000, the nine largest telecom equipment suppliers had a combined $25.6 billion in vendor financing loans to customers.

While such measures of financing may seem extraordinary from the perspective of 2009’s deep recession, keep in mind that such actions came shortly after the unprecedented economic boom of the 1990s. But, as we shall later see, Verizon’s investments in other properties were predicated on these companies, in turn, subsisting through additional vendor financing strategies. (By August 2001, Verizon was forced to write off half of its $5.9 billion investment portfolio.)

Verizon also established the Verizon Foundation, with the intent to distribute 4,000 grants of $70 million, through an all-online process. This, of course, replicated the funds and the efforts of the Bell Atlantic Foundation. (Not counting for inflation, this figure would remain more or less consistent throughout the years. In 2008, the Verizon Foundation awarded $68 million in grants, roughly 6.4% of its profits from Q1 2008. The Verizon Foundation’s financial statements can be examined here.)

Verizon also established the Verizon Foundation, with the intent to distribute 4,000 grants of $70 million, through an all-online process. This, of course, replicated the funds and the efforts of the Bell Atlantic Foundation. (Not counting for inflation, this figure would remain more or less consistent throughout the years. In 2008, the Verizon Foundation awarded $68 million in grants, roughly 6.4% of its profits from Q1 2008. The Verizon Foundation’s financial statements can be examined here.)

There were also advertising costs. The tab at Draft Worldwide and Zenith Media was $500 million.

The now ubiquitous practice of SMS text messaging was, near the end of 2000, not widely practiced in the United States. This was a bucolic and more innocent time in which people ate dinner with each other and actually had to wait several hours before telling other friends who they were hanging out with. You might say that before 9/11 “changed everything,” SMS “changed everything.”

While businessmen in Japan and Europe texted each other during meetings, it was not until the fourth quarter of 2000 that telecom communities began rolling out two-way SMS service, and cell phone customers could send text messages to each other of no more than 160 characters. The problem, in the United States, involved conflicting and competing standards.

It is necessary to begin at the beginning and briefly (but, by no means, sufficiently) explain these developments. In the early 1980s, emerging cellular telephone systems were creating numerous incompatibilities and frustrations. Enter a group of fussy European telecommunications administrators determined to solve the problem with a compatible system called Global System for Mobile, or GSM. At the risk of skipping over some vital SMS/GSM history and leaving out a good deal of important and interesting figures, let’s just say that they sorted everything out. (I hope to expand this section in the future.)

On December 3, 1992, in the United Kingdom, the first SMS message was sent by engineer Neil Papworth through the Vodafone network (before it was merged into Verizon Wireless). It read MERRY CHRISTMAS. But it would take seven years before the phrase, “Text me,” would enter into the lingua franca.

It took some time. But upon establishing a cost of about 10 cents per message, text messaging became popular in Europe, particularly in Scandinavia, where many of the GSM originators resided. In October 2000, 157 million European wireless customers were SMS-ready. 9 billion SMS messages were sent every month. The price point created a premium that seemed affordable to teenagers and doctors alike, but this was a lucrative markup that remains a source of controversy today. (Indeed, in October 2008, Verizon Wireless had plans to tack on an additional 3 cents per text message.)

The SMS standard used in Europe was GSM, but the US used three separate standards: TDMA (Time Division Multiple Access), CDMA (Code Division Multiple Access), and a GSM variation that, much like the American NTSC television standard abandoned in 2009, was incompatible with numerous global territories. A Verizon Wireless customer in 2000 could not send a text message to a AT&T Wireless customer. And this lack of global SMS compatibility, together with the then-awkward requirement of typing an email address before sending a text, didn’t exactly win customers over.

The SMS standard used in Europe was GSM, but the US used three separate standards: TDMA (Time Division Multiple Access), CDMA (Code Division Multiple Access), and a GSM variation that, much like the American NTSC television standard abandoned in 2009, was incompatible with numerous global territories. A Verizon Wireless customer in 2000 could not send a text message to a AT&T Wireless customer. And this lack of global SMS compatibility, together with the then-awkward requirement of typing an email address before sending a text, didn’t exactly win customers over.

AT&T Wireless got many of its customers hooked on text messages by offering SMS for free through February 2001. (AT&T would initially charge $4.99 for 500 messages a month, a considerable bargain compared to Verizon’s text message rates today.)

One unexamined consideration is whether Verizon, which owned and maintained all the pay phones in the New York subway stations, deliberately let these pay phones fall into disrepair. After all, why not move these disgruntled pay phone customers onto cell phone plans? And why not work with the city to establish a cell phone network within the cavernous subway system? Verizon, as it turns out, was better at repairing pay phones in 2000 than the year before under Bell Atlantic. According to the Straphangers Campaign, 18% of subway station pay phones were broken in October and November of 2000 (compared to 25% in August 1999). Whether the drop came from reduced crime or reduced pay phone use, it is difficult to say. But as Farouk Abdallah of the Straphangers pointed out at the time, Verizon’s contract with the MTA called for 95% of the pay phones to be “fully operative and in service at all times.”

Pay phones, however, were on the wane. When the City of New York announced that it would construct 2,262 new public pay phones, a number of Upper East Side residents, who presumably possessed the expendable income needed to pay for a cell phone, complained about the 1,000 pay phones appearing in their neighborhood. Never mind that only half of New York residents had cell phones and 20% of residents in poorer neighborhoods didn’t even have regular phones. The pay phone kiosks would be an eyesore. Verizon, interestingly enough, did not apply to operate the new phones.

Pay phones, however, were on the wane. When the City of New York announced that it would construct 2,262 new public pay phones, a number of Upper East Side residents, who presumably possessed the expendable income needed to pay for a cell phone, complained about the 1,000 pay phones appearing in their neighborhood. Never mind that only half of New York residents had cell phones and 20% of residents in poorer neighborhoods didn’t even have regular phones. The pay phone kiosks would be an eyesore. Verizon, interestingly enough, did not apply to operate the new phones.

Three months before the United States would enter a nine-month recession in 2001, shares in Verizon fell $3.94 on December 20, 2000 to $51.88. Despite the 3,500 DSL lines that Verizon claimed it was installing daily, Verizon seemed more interested in promulgating financial projections for 2001 and 2002 rather than coughing up any data about the present. (Lucent, that seemingly dependable equipment vendor who had bet the farm on vendor financing, announced two days later that it would lose more than it had anticipated and that layoffs were forthcoming.)

And the customers wanted more. They wanted nationwide coverage that wasn’t lossy. Analysts suggested that the infrastructure wasn’t there and couldn’t support the dramatic uptick in customers. Could the customer understand that a cell phone was entirely different from a landline? Did they know the difference between an analog and a digital phone? Did they understand that using all those minutes in the package was a trap to get customers reliant upon cell phones? Did they consider that maybe it was the telecom companies who held all the cards in the relationship? Or perhaps increasing and often unreasonable demands were a way for the customer to feel that he had some power or confidence?

New Review

My review of Chuck Barris’s Who Killed Art Deco? appears in today’s Chicago Sun-Times. And truthfully, the review is far crankier than I remember it being when I filed it. Indeed, the piece is more than a bit ridiculous with some of its pedantic quibbles. I don’t know how many reviewers would actually confess such qualities, but I am committed to candor. This is a Chuck Barris novel, for crying out loud. Not a Donald Westlake novel. But it was an annoying book with homophobic conceits.